Search

Limited market awareness hinders rental service penetration

Mukesh Sharma, Country Manager, Atlas Copco Specialty Rental Division in India, speaks on the current landscape of the construction equipment rental market, and the latest trends in the market.

Budget 2024: Key highlights

Key highlights of Interim Budget 2024

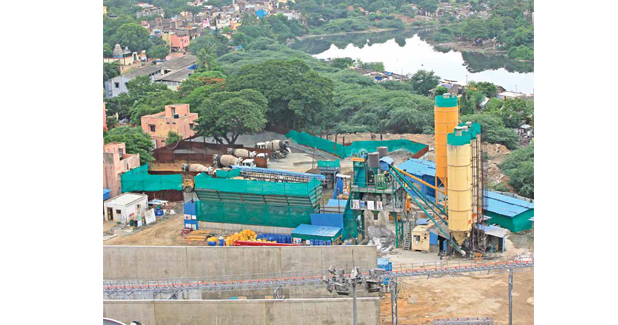

CONCRETE BATCHING PLANTS

Concrete is a major constituent of infrastructure projects: mainly in real estate, roads and highways, railways, sea ports, airports, power plants, irrigation and urban modernisation sectors.

Rolling ahead

Roads and highways is still going strong as the most happening infrastructure sector in India with many ongoing projects and many in the pipeline. India has the second largest road network across the world at 4.7 million km and is still growing.

Ready for the Big Boom

Large capacity concrete batching plants are to piggyback upcoming 100 new concrete roads and other infrastructure projects. Mass concreting is expected to be a major constituent of upcoming infrastructure projects in roads and highways, railways, sea ports, airports, power plants

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com